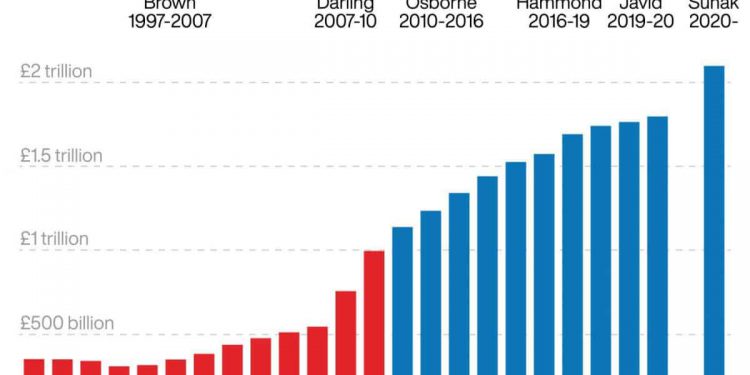

Watch what happens to the UK's debt pile under the Conservatives

Despite claiming to become the party of fiscal responsibility, the UK’s debt pile under the Conservatives has grown exponentially in the last decade.

Often weaponised from the Labour Party within the elections of 2010 and 2021 it has increased in every year since the Tories took charge, and has grown at an alarming rate this season.

Government borrowing surged to a record lb31.6 billion in November as efforts ramped up to support the economy with the second wave of the pandemic, official figures show.

The Office for National Statistics (ONS) said last month's borrowing – excluding state-owned banks – soared by lb26 billion year on year and marked the highest seen in November and also the third highest in almost any month since records began in 1993.

The latest estimate saw public sector net debt reach a brand new all-time high of lb2.1 trillion at the end of last month.

It means the UK's overall debts are now around 99.5 per cent of gross domestic product (GDP), that is a measure of how big the economy – an amount not seen since 1962.

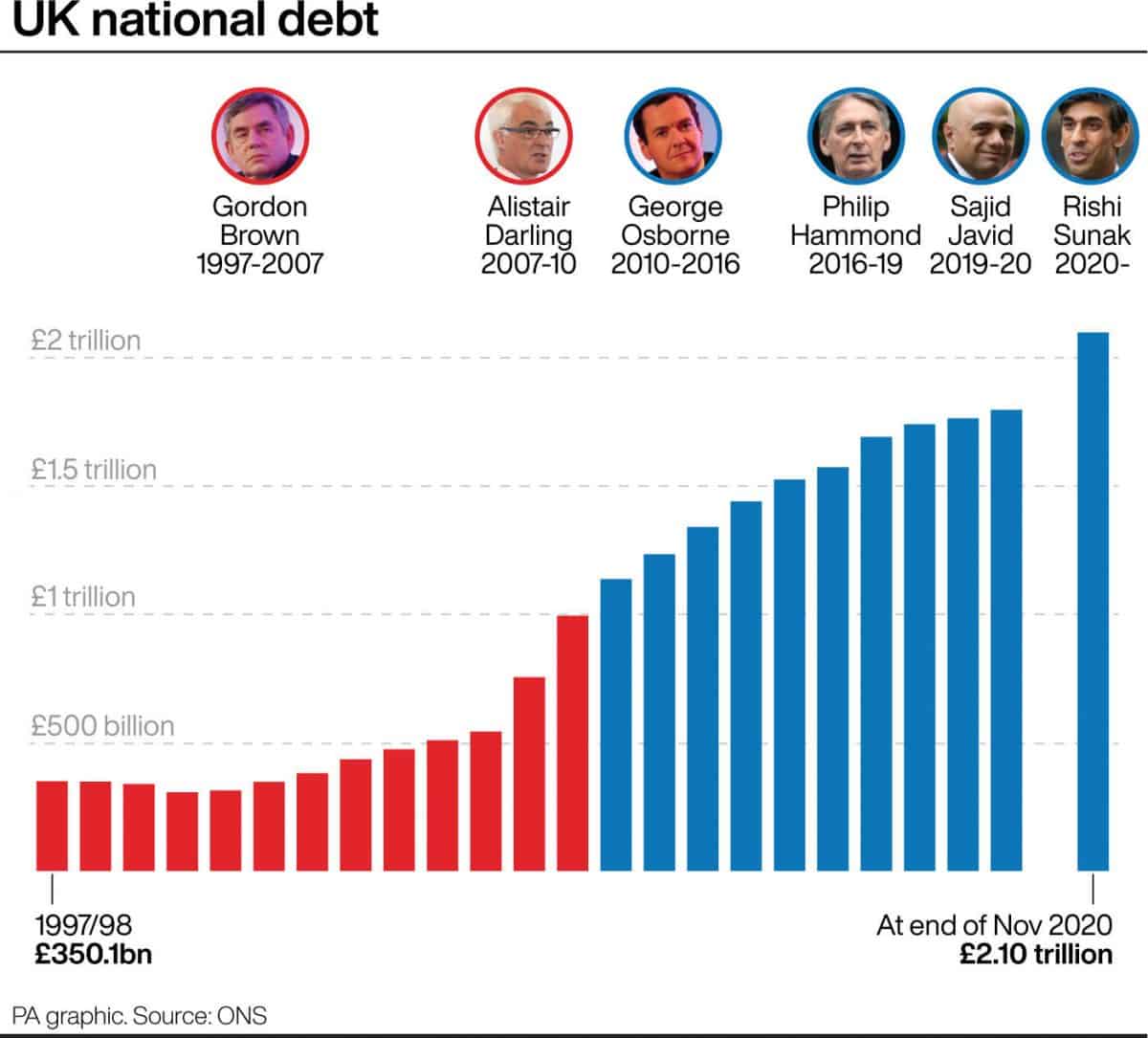

Borrowing has hit lb240.9 billion for that first eight months of the financial year – lb188.6 billion more year on year and breaking yet more records.

Recent official forecasts in the Office for Budget Responsibility (OBR) predict borrowing could reach lb393.5 billion after the financial year in March, which may be the highest seen because the Second World War.

Furlough

It comes after the federal government launched more than 40 schemes across the UK to assist households and businesses with the coronavirus crisis.

One of the most costly continues to be the furlough scheme for workers, that was last week extended again until April 2021.

The most recent figures from HM Revenue & Customs showed another lb3.4 billion worth of claims were created between November 15 and December 13, taking total states lb46.4 billion and 9.9 million furloughed jobs.

The ONS said borrowing rose as tax and National Insurance receipts fell by lb38.3 billion – or 8.6 percent – every year within the eight months to November.

But government support for individuals and businesses during the pandemic led to a 30 per cent or lb147.3 billion hike in central government spending.

Howard Archer, chief economic adviser towards the EY Item Club, cautioned the furlough extension and additional Government support could send borrowing ballooning to more than lb400 billion this financial year.

Deficit

He said: “If the trend from the first eight months of fiscal year 2021/21 continued, your budget deficit will come in around lb264 billion.

“However, it appears prone to are available in significantly higher than this with the furlough scheme now being extended until April and other supportive fiscal measures announced for that economy within the recent Spending Review.

“Indeed, if introduced, more support for businesses impacted by Tier 4 restrictions may potentially send your budget deficit above lb400 billion.”